By Gabrielle Pepin and Kane Schrader

June 15, 2023

Much has been made of the new SNAP work requirements in the debt ceiling deal recently passed by Congress and signed into law by President Biden. Not receiving nearly enough attention are changes to work requirements for cash assistance that could gut federal funding for programs in several states.

In the United States, cash assistance for low-income families with children is administered at the state level through the Temporary Assistance for Needy Families, or TANF, program. States receive about half of their TANF funding from the federal government if they meet spending requirements and have a certain proportion of families engaged in work-related activities, such as employment and job training. The debt ceiling law makes one seemingly small change to how states’ work requirements are calculated that makes them harder for many to satisfy.

Currently, for states to receive full federal funding, 50 percent of their TANF families must work.[1] However, the 50 percent threshold may be reduced by a “caseload reduction credit”: the percentage decrease in the state’s TANF caseload since 2005. For example, if a state’s number of TANF families has decreased by 30 percent since 2005, then only 20 percent of its current caseload needs to be working.

Given substantial decreases in TANF participation during the 2000s and early 2010s, many states have faced lax work requirements in recent years. As of fiscal year 2021, the latest year for which data are available, 30 states did not face the work requirement because their caseloads had decreased by more than 50 percent over the past decade and a half.

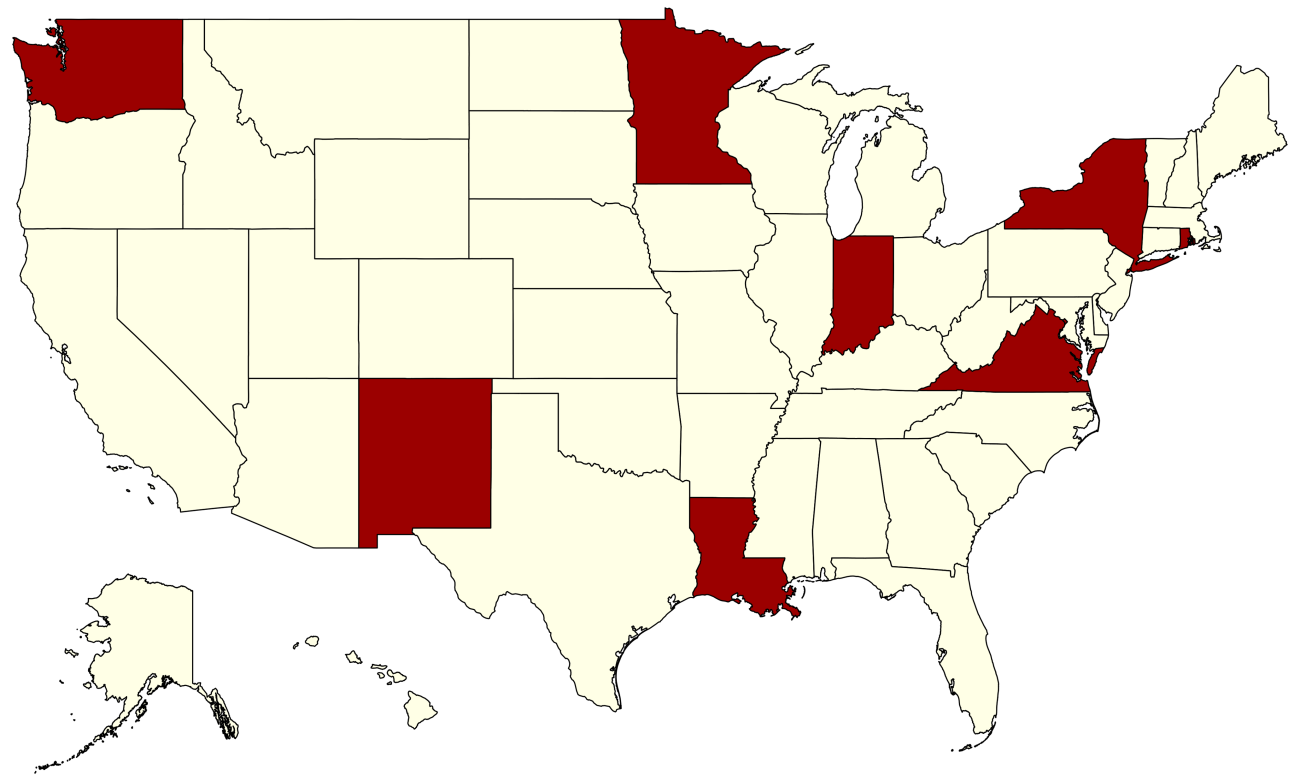

The new debt ceiling law stipulates that, beginning in fiscal year 2025, the caseload reduction credit will be based on the change in a state’s caseload since 2015, rather than 2005. Shortening the time horizon tightens work requirements in many states. We estimate that, if trends in caseloads continue over the next couple years, eight states—below, in red— that met eligibility requirements as of fiscal year 2021 will no longer be in compliance.

Failure to meet the new standard poses a serious threat to states hoping to maintain their programs, which could face penalties worth up to 25 percent of their federal block grants. If TANF spending were to dry up completely, a typical three-person family would experience an income loss of around $200 to $1,100 per month, depending on the state in which they live. As most families on TANF receive no other income, these changes likely would affect living standards and increase rates of extreme poverty.

There are a couple of options for states at risk of losing federal funding that want to support low-income families. One option is to increase sanctions, or penalties, for individuals who do not work. This would encourage families to work to avoid losing benefits, though evidence suggests the threat of losing benefits may be ineffective.

Moreover, states could do away with meeting the federal work requirement altogether and spend more from their own budgets on cash assistance. However, decreases in expenditures on cash assistance in recent years, coupled with political sentiment against it, suggest that states may be reluctant to do this.

Other strategies that states have exercised are unlikely to be effective under the new rules. For example, decreases in caseloads due to stricter eligibility criteria do not count towards states’ caseload reduction credits. Additionally, under the new rules, states may no longer count families receiving benefits of less than $35 per month towards their work requirements. Some states have been providing such token payments to working individuals to boost their numbers.

Given that several states are unlikely to meet new federal work requirements and even small decreases in income could reduce living standards among families affected by TANF policies, low-income families likely will require additional supports once the new rules take effect. As resources during childhood affect health, educational attainment and earnings during adulthood, policymakers who fail to act risk fueling poverty for years to come.

[1] We focus on work requirements for all TANF families with adults in the assistance unit. Child-only cases, in which children typically live with grandparents or other relatives, do not count toward the federal work requirement. The work requirement for two-parent families, who constitute about 10% of the TANF caseload, is 90%, less a caseload reduction credit.