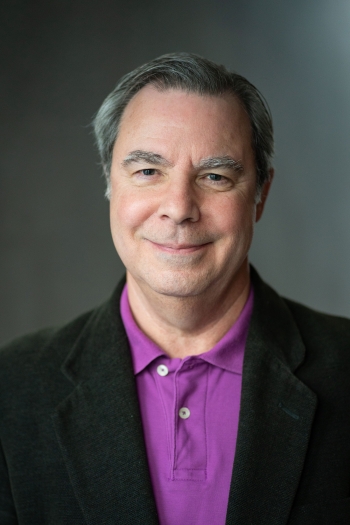

Chris O’Leary’s research aims to identify ways of improving public employment policies including both unemployment insurance and active labor market programs.

Chris O’Leary’s unemployment insurance (UI) research has examined experience rating, benefit adequacy, profiling, and personal reemployment accounts. Through field experiments he has studied UI programs for reemployment bonuses, partial benefits, and work sharing. In Canada, China, Brazil, Hungary, Poland, and Serbia he has done impact evaluations and performance monitoring systems for job training, wage subsidies, self-employment assistance, and public service employment. His research has been supported by the World Bank, ILO, and OECD. Recently for the U.S. departments of Labor, Agriculture, and Health and Human Services he has analyzed cross program usage of UI, welfare, food stamps, and employment services. O’Leary earned a BA at the University of Massachusetts and a PhD in economics from the University of Arizona. He was elected to the National Academy of Social Insurance in 1999.